Understanding and Leveraging Supply Demand Anomalies in the Mobility Industry

The pandemic disrupted the mobility industry immensely, but the two primary variables for optimizing uptake of your mobility assets remain the same: price and placement. You can do both more profitably with accurate demand forecasts, yet anomalies still occur and can have major impact in this hyper-competitive industry. So how do you prepare your team and fleet to be best positioned for anomalies that drive demand up or down?

Exploring some of the key factors involved in understanding demand fluctuations in the MaaS industry will enable participants to learn from each other and tackle some of the big challenges for transport businesses.

This is a topic I am passionate about because we work with some of the world’s leading rideshare companies, as well as a range of other mobility and transport providers.

Most companies prioritize placement over price wars

While ridesharing companies can and do focus extensively on price and driver incentives, placement is make-or-break for every business in this space.

Whatever you’re working with—cars, scooters, bikes, vans, boats, or something else—knowing where demand will hit ahead of time ensures you are in the best possible position to get maximum uptake and market share as well as improve labor efficiencies. For example, if you know when and where a concert is playing and how many people are expected, you can be ready to meet those looking to get home, rather than noticing a surge in demand that will be over by the time you have responded and got assets in the right place.

Smarter placement increases both ride numbers and profit-per-ride, and is a particularly pertinent issue for companies that are constrained by city or country regulations based on the volume of assets they can have at particular locations. If you can only have six bikes at each bike rack in an area that is about to experience peak demand, you’ll need a well-planned strategy for rapid replenishment.

It is also hard to deviate from known hotspots of demand (such as outside of a popular sports venue or conference center); however, knowing how to predict where people will be and/or where they need to get to is key to optimization. With the changes to people movement, events and consumer behavior the COVID-19 pandemic has caused, understanding in advance what events will drive demand for your business has never been more important.

Being proactive about placement and predicting upcoming demand anomalies means you can ensure you have assets ready, before a location shows even a hint it’s about to become a hotspot. This is critical because there is no automated way to shift your assets. By the time you are aware a demand spike is occurring, chances are it’s too late to capture a sizable portion of it.

We need to consider mobility’s demand elasticity when identifying anomalies

MaaS companies have the potential to address many use cases. But, this also leads to a range of different competitive situations, which each need to be understood to be best optimized.

For example, when a 10,000-attendee concert ends, users will prioritize immediate access to get out of the crowd before the queues and wait times kick in. A large conference will have a similar impact, as will time-sensitive trips such as getting to the airport or a key, timely event.

Other than events, severe weather can cause unexpected surges and plunges in demand – causing even frequent scooter-hire customers to pull out their phones and open up a rideshare app instead.

This is different from the more sustained, less urgent demand than when immediate discovery and use is critical for uptake.

Tapping into perfects storms of demand

It’s important to understand these differing levels of demand urgency when optimizing your strategies, especially when it comes to preparing for perfect storms of demand. These occur when smaller events cluster and combine to have a similar impact to a large, well-known event.

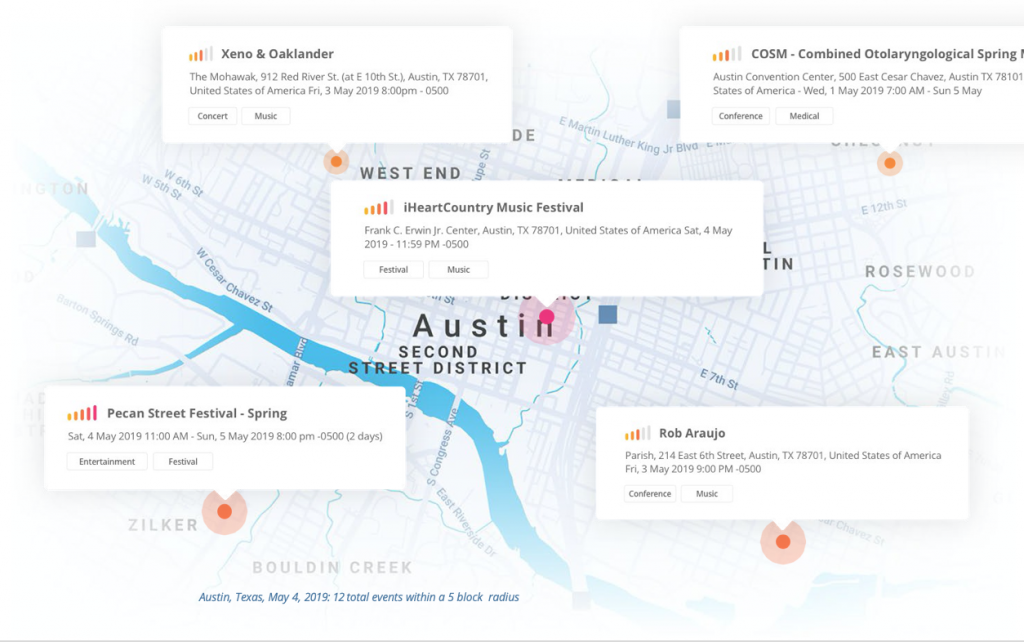

For example, this perfect storm in Austin, Texas is made up of events that are ranked mostly below major and significant event impact. This is drawing close to 650,000 people to the area — all of whom need ways of getting around — and would easily be missed compared to a similarly sized, single event. Perfect storms are particularly important as the world recovers from the COVID-19 pandemic, as smaller events are returning faster than very large ones. Knowing how event clusters interact and compound impact is a unique advantage.

Perfect storms are particularly impactful for mobility companies as they will cause unexpected demand and displacement of assets.

Context: How mobility operators use PredictHQ

Transport companies use our intelligent event data in two ways:

Directly in their demand forecasting models.

As a way to save city and operational managers’ time while ensuring they are aware of all event-driven potential demand anomalies.

Most companies use it directly in their modeling. Our API is designed for ease of use with an identical schema regardless of event type and the ability to swiftly correlate historical data with verified and ranked events.

Correlation of mobility demand with events reveals three important insights:

What kind of events cause increase and decreases in your demand, so you can identify for future events and optimize your plans.

Unexpected or under-appreciated hotspots that require inclusion in your strategies and potentially greater investment to capitalize on demand surges.

The ability to move beyond “we had a spike here last year” to pinpointing exactly why you experienced that spike and ensuring you can meet it again. Many events recur, and 85% of recurring events change location or date each time.

While many transport companies scrape Google for events or have a list of key holidays, having a much larger set of verified and ranked events means you can identify more demand anomalies reliably enough to shift assets and teams in advance to meet demand. One of my favorite moments with new customers is watching the relief and excitement from engineers and data scientists when they realize our demand intelligence data has a consistent schema and ranking methodology – saving them hundreds of hours cleaning and formatting data.

We started building our demand intelligence offering around events as one of the largest and hardest to predict sources of demand catalysts, but we’re only just getting started!