Accommodation groups need high ROI external demand data: how a global hotel chain is saving $90 million a year with PredictHQ’s data

As hotel and accommodation groups prepare for what is expected to be the “sharpest RevPAR recovery ever forecasted” (source), they are also grappling with a highly fragmented and dynamic environment. Gone are the days of rolling historical averages, as properties will command starkly different occupancy and pricing as an uneven pandemic recovery begins.

Predictions by CBRE have US occupancy rates reaching 60% in 2021, with RevPAR reaching 57.5% on average. Economy accommodation is predicted to be the fastest to recover, with McKinsey estimating luxury hotels will need 1.5 times the occupancy rate to recover. Every accommodation company needs to bring their A-game to the recovery.

If we’ve all learned anything from 2020, it is that a lot can change very quickly. As neither 2019 nor 2020’s data is enough on its own in demand forecasting, most accommodation companies are switching towards continuous forecasting models, fuelled by external high quality data sources.

The right external data will make your core processes smarter: forecasting, pricing and labor optimization

Fundamental to this process is using data to pinpoint what drives your demand so you can prepare. We work with some of the largest hotel chains and accommodation marketplaces in the world and below is a high-level summary version of the first step of our impact quantification process. An identical or similar process will work for many other data sources that inform what drives demand so machine learning models can create more accurate forecasts.

The PredictHQ team goes through this process for every customer. Once we have identified the impact of our data on their demand forecasting accuracy, our value quantification team assists to model out what this improvement means for the bottom line. One global hotel chain with more than 6,000 properties using our data stood to save $90 million a year.

Below is a generic example to share the high level process with you. There is substantially more to the process, which is tailored to each customer’s situation and business priorities. To make this summary accessible to most, we have made a series of hotel industry assumptions that are drawn from our experience with our customers.

Data inputs

Let’s assume there are two hotel chains, one has a total of 900 large hotel properties, while the other has a total of 1,500 small hotel properties. Each of these hotel chains’ goals are to better predict high and low demand days in the future so that they can capitalize on this information and take specific pricing actions and ensure occupancy rates are in a sweet spot. With PredictHQ event data, these two hotels will have the ability to take a much more proactive approach to revenue management, driving greater profitability. Now let’s look at the metrics of a single property for each of these two hotel chains in the city of Chicago:

| RevPAR | Occupancy | Number of rooms | Average daily rate | Annual Room Revenue | |

|---|---|---|---|---|---|

| Large hotel | $138.75 | 75% | 335 | 185 | $16.9M |

| Small hotel | $65.70 | 73% | 75 | 90 | $1.8M |

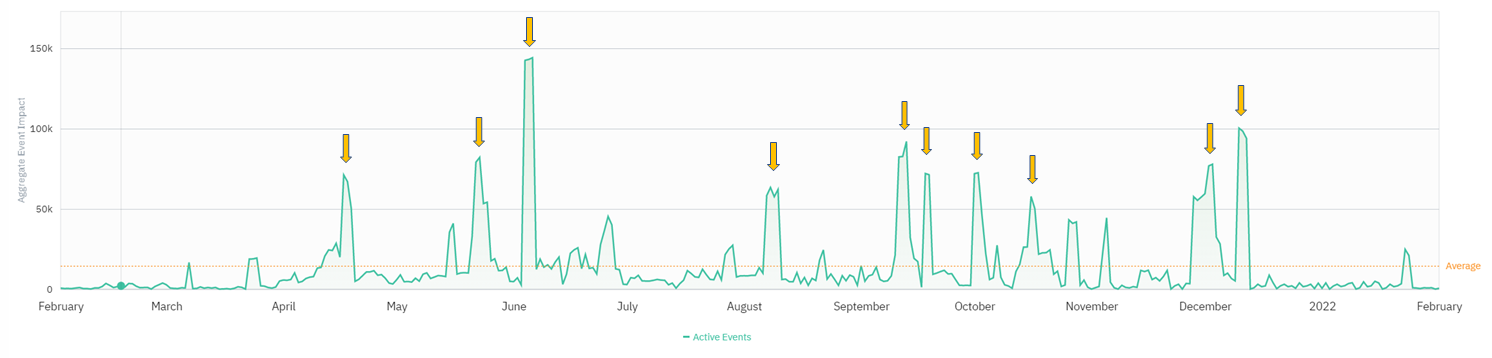

Now let’s take a look at our Aggregate Event Impact data for the city of Chicago. Our aggregate event impact shows high impact days where events are driving tens or hundreds of thousands of people into a region. Similarly, our data also shows low impact days driven by either a lack of events or events that cause decremental demand. Our data shows that for the next twelve months for the city of Chicago there are approximately 18 days in which there will be anywhere between 70,000-150,000 people attending a major event which drives demand for hotels nearby. The graph below shows when the city will experience high demand over 2021 (please keep in mind events are only just beginning to be scheduled as the vaccine rolls out).

Calculation

In this case we’re exploring the impact of PredictHQ’s data, which identifies the events that impact demand. While the below is only a high-level step in identifying if an external data source will deliver ROI, it is a good go/no-go sign to keep exploring it. Companies begin by correlating their historical data to our 5+ years of verified, historical event data to pinpoint which events impact their bookings, but also their food and beverage offerings, which are impacted by events that may not impact bookings as much. But this process works for assessing most external data’s potential.

| Predicted high/low impact days in a year(1) | Assumed actionable high/low impact days(2) | Occupancy (before PredictHQ) | Occupancy (after PredictHQ) | Avg Price Change | Room Revenue Increase | RevPAR Improvement | |

|---|---|---|---|---|---|---|---|

| Large hotel chains with predicted high impact days of bookings >70% | 18 | 9 | 78% | 77% | 5% | $15.8K | 0.4% |

| Large hotel chain with predicted low impact days of bookings <50% | 31 | 61 | 48% | 53% | -5% | $44.4K | 0.4% |

| Small hotel chains with predicted high impact days with bookings >70% | 18 | 9 | 76% | 75% | 5% | $1.7K | 0.5% |

| Small hotel chain with predicted low impact days of bookings <50% | 61 | 31 | 46% | 52% | -5% | $7.0K | 0.5% |

A few notes on the above:

Our aggregate event impact shows high impact days where events are driving tens or hundreds of thousands of people into a region. Similarly, our data also shows low impact days driven by either a lack of events or events that cause decremental demand. However, the impact of events differs widely for each company, so we have developed a sophisticated process to identify exactly what kind of events impact each customer and when, so we can pinpoint their high and low demand days with much higher precision.

Inherent in this model is an assumption that most hotel companies already take action on some high or low demand days, once they have identified them. This is often after many rooms have been booked at a lower yielding rate or package, or later on in the booking curve than when sell-through pricing would help mitigate losses.

Summary: Dynamic pricing benefit

If we assume that each of these hotel chains achieve this level of demand predictability across a third of their portfolio of properties for the next twelve months, this is what the estimated revenue impact could look like:

| Annual Revenue Improvement | |

|---|---|

| Hotel chain of 900 large hotels | $18.1M |

| Hotel chain of 1,500 small hotels | $4.3M |

Beyond pricing: $90 million a year saved through investing in better demand impact data

But the opportunity of demand intelligence beyond dynamic pricing is substantial. For example, one of our customers was able to forecast savings of tens of millions a year through two improved forecasts that enabled more efficient matching of staff requirements while still ensuring excellent customer service based on a:

10% improvement in guest arrival and departure time.

25% improvement in Food & Beverage forecasting.

Workforce investment takes up around 50% of most accommodation group’s operating expenses, and having more accurate forecasts, means hoteliers can optimally match labor to predicted demand. This can drive efficiencies across hotel chains' portfolio of properties which can yield a significant impact to the bottom line.

Whether it’s a sports match, a school holiday, severe weather, a major conference, or a college graduation, events cause millions of people to make purchasing decisions every week. While the impact of scheduled attended events such as conferences and sports can feel remote during the pandemic, many countries are beginning to ease restrictions and mass event bans over the coming months. Being ready for these events to return and making the most of the thousands of ongoing events such academic events and observances will ensure you can meet demand while running a lean team.

Find out more about how they did it here.

Invest in intelligence to enables your models and teams to make better decisions at scale

The pandemic year was brutally hard. And the recovery year is going to be challenging as well, but we can all see the light at the end of the tunnel. At PredictHQ, we can see that light clearer than most, because we can see the large demand-driving events that are already being scheduled throughout 2021.

Our accommodation customers have access to every event that is being scheduled this year, and in many cases, rescheduled events that were postponed last year. The calendar of large events looks different this year - so much so we are producing a report about the upcoming events and key insight for accommodation companies in March 2021. Get in touch with our team to ensure you receive it.

But it will only have the events scheduled already, and the event rescheduling rate is increasing and likely to for the rest of the year. Reach out to our team to find out which events impact your demand, how you can track them and take advantage of our quantification teams to understand how this investment will enable your teams to chart the best course through this coming hopeful and chaotic year of economic recovery.