Bigger than the Super Bowl: Why Super Bowl weekend is only the fifth most lucrative event for local businesses this February

The Super Bowl - and its economic impact on its host city - is big for sure, but for demand forecasters and planners, there are four events that will drive more local spending this month than the NFL’s biggest game.

If you’ve found this blog, you’re probably here because you want to better grasp how we arrived at our list of the five most lucrative events in February 2023 and to understand how our Predicted Event Spend model (which is in beta) works. Here’s the list, and below is how the model that built it works.

The five largest events by economic impact for local businesses in February 2023 are:

New York Fashion week will generate $331,150,000. This includes $233.6 million for accommodation; $18.9 million for transport and $79.5 for restaurants.

New Orleans Mardi Gras will generate $155,430,800. This includes $69.6 million for accommodation; $24.7 million for transport and $60.9 million for restaurants.

Fort Worth Stock Show & Rodeo will generate $142,137,000. This includes $52 million for accommodation; $21.8 million for transport and $68.1 million for restaurants.

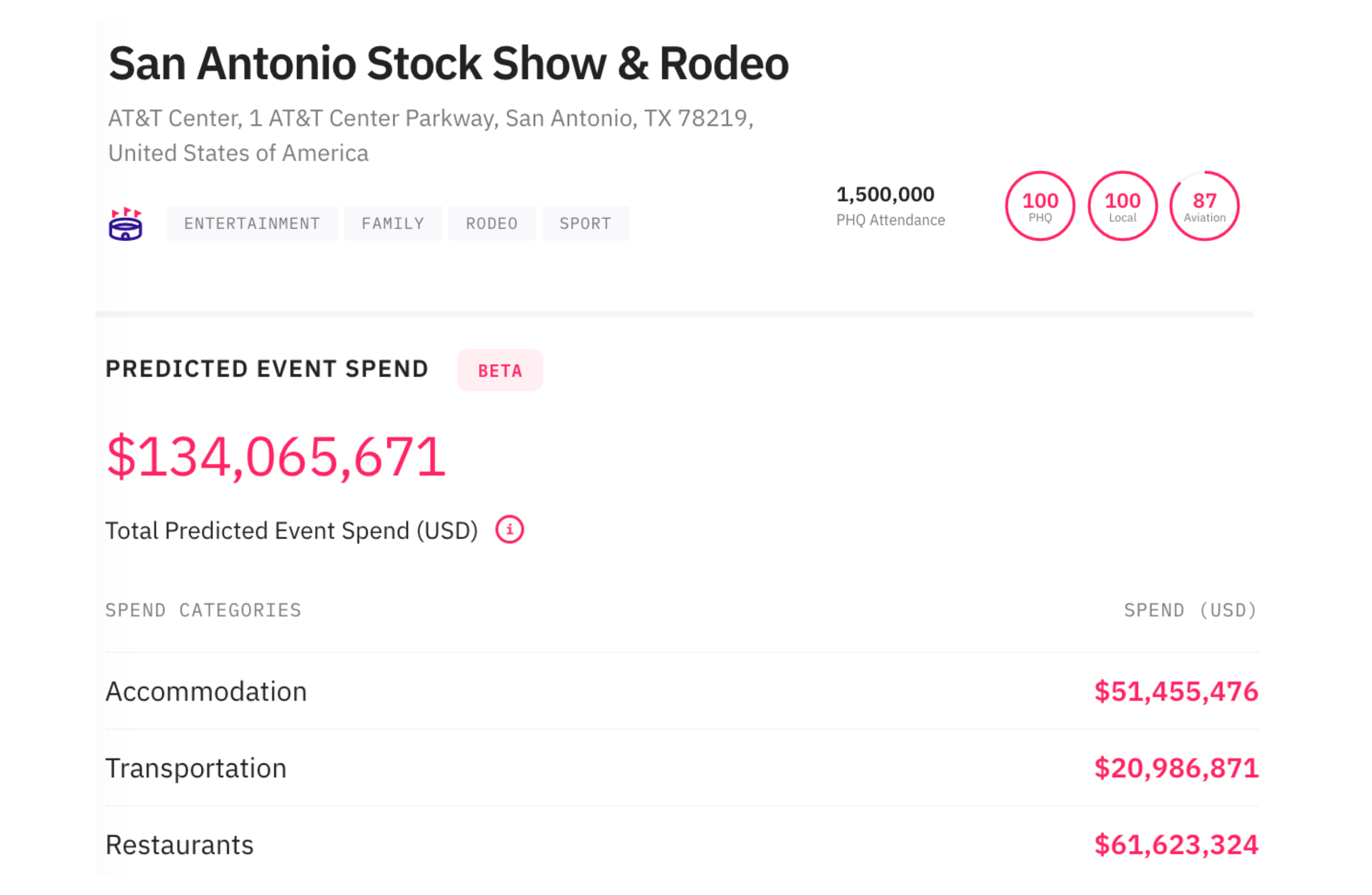

San Antonio Stock Show & Rodeo will generate $134,065,000. This includes $52.4 million for accommodation; $20.9 million for transport and $61.6 million for restaurants.

The Super Bowl weekend (all Super Bowl events in Phoenix from February 9 - 12) will generate $123,780,000. This includes $78.5 million for accommodation; $12.8 million for transport and $34.8 million for restaurants.

The Predicted Event Spend Model in a nutshell

The Predicted Event Spend Model generates a figure for how much spending on accommodation, restaurants and transportation an event will cause. It speaks directly to the value of an event for local communities in terms of business income. Take a look at the San Antonio Stock Show & Rodeo's Predicted Event Spend below:

How does the model arrive at its figures?

We use the predicted attendance our models generate for each event, and combine it with a series of assumptions based on the event category and type. For example, for the Super Bowl weekend, the model assumes two people per hotel room, and that most people would stay the night before as well as the night after the Super Bowl.

The Super Bowl is a particularly interesting event for identifying its spending impact as there are ~45 events in Phoenix around the game itself. To arrive at a meaningful number, we refer to the events that make up the Super Bowl weekend and the aggregation had to be more than a simple sum of predicted attendance, which would have resulted in significant overcounting of attendees. We estimated the number of daily unique visitors based on whether events occur at the same time (so represent separate, different crowds) or whether an event is free vs. ticketed (if it is free then people are likely to "drop by" for a visit, but if ticketed then this is major event in their day - so attendees at free events are not counted as they will be counted at ticketed events occurring on the same day.

These were just some of the complexities our Predicted Spend Model deals with for major events. The core assumptions used by the model re spending are informed both by value quantification norms, anonymized customer transaction data, and spending/socioeconomic data from 7,000 locations.

Why we built our Predicted Event Spend Model

Most economic impact calculations focus on a wide range of factors including taxes, wages and in the case of sports games - ad revenue and more. The figures are high, and not helpful for local businesses near the event that are trying to gauge the scale of impact.

Our customers - coffee companies, QSR chains, transport groups and accommodation providers - wanted a reliable estimate for an event’s impact on local businesses. PredictHQ models have been tracking and verifying events for years. We’ve built thousands of models to make sure our event details are right, including one that predicts the attendance at events, drawing on historical data, performer data, venue and more.

The accuracy of the predicted attendance model, when combined this value quantification norms such as assuming an average hotel room increase for peak periods, and average per day meal spends, enabled us to build the Predicted Event Spend model.

Why the Super Bowl generates less for local businesses than major stock shows, fashion weeks and more

There are several major factors that can drive Predicted Event Spend higher or lower. In these cases:

The event’s predicted attendance: the relationship is not always more people equals more spending. For example, a massive local food festival of 10,000+ can generate less spending for nearby businesses than a conference of 2,500, if most of its attendees are flying in for the event, needing accommodation and food.

What proportion of attendees are local compared to coming from out of town

Its duration - the largest investment is in accommodation, and a longer event will necessitate more nights booked.

The average cost of accommodation, restaurants and transport in each location drawing on spending/socioeconomic data for 7,000 locations worldwide.

The Super Bowl weekend is the shortest of the top five events this month, and also the event likely to have the highest proportion of families in attendance i.e. more guest per room than say New York Fashion Week.

Our Predicted Event Spend tool is available in Control Center. Access your free account.