Coronavirus Impact: Only 33% of Large Events Were Cancelled – Most Were Postponed. How to Track Rescheduled Dates Now and into the COVID-19 Recovery

The novel coronavirus has caused devastating loss of life and significant economic stress. While we still have several months at least before we are able to resume normal life and an economic rebound begins, many of our customers are already working to update their demand forecasts to ensure they can access every incoming demand opportunity once restrictions lift.

For new readers of the PredictHQ blog – our systems aggregate and standardize millions of events worldwide, then we rank them by predicted impact. This gives us unique insight into how swiftly demand was evaporating last quarter. In February, the world experienced a record-breaking 500% increase in cancellations or postponements of significant and major events compared to the previous February. In March, this shot up even further to 825%, as many countries implemented lockdown or similar restrictions, which caused widespread postponements of events.

It’s a tough time for business. If there is a silver lining of this monumental shift, it’s that of the event changes only a third globally have been cancelled, compared to 66%, which have been postponed. For example, sports is one of our most impactful categories and in the US, only 11% of significant to major events have been cancelled, compared to 89% postponed.

For example, here are four major events in the USA that have been postponed rather than cancelled:

The Boston Marathon in Boston

Sun ’n Fun Aerospace Expo in Florida

The Sea Otter Classic (cycling + outdoor sports festival) in Monterey

The New York International Auto Show in New York

Postponements rather than cancellations is good news in these difficult times because every rescheduled event will be an opportunity for your team when the recovery begins. But when are all these events being rescheduled? In this blog we will explore what our data suggests as companies around the world try to make sense of these unprecedented times.

As soon as events begin to be rescheduled and new events scheduled at scale, we will be publishing weekly updates on the rate at which is this occurring in key markets as well as highlighting some of the highest impact events and clusters of events organized that week.

When will the COVID-19 recovery begin?

No one knows exactly when health authorities and countries will get the virus under control. But events are useful indicators of demand, and serve as catalysts for it, causing people movement and purchasing. They are complex to predict accurately and require hundreds of sources and many machine learning models to aggregate, standardize and verify them. But they are make-or-break for optimized demand forecasting, especially now when events are a leading indicator of demand recovery.

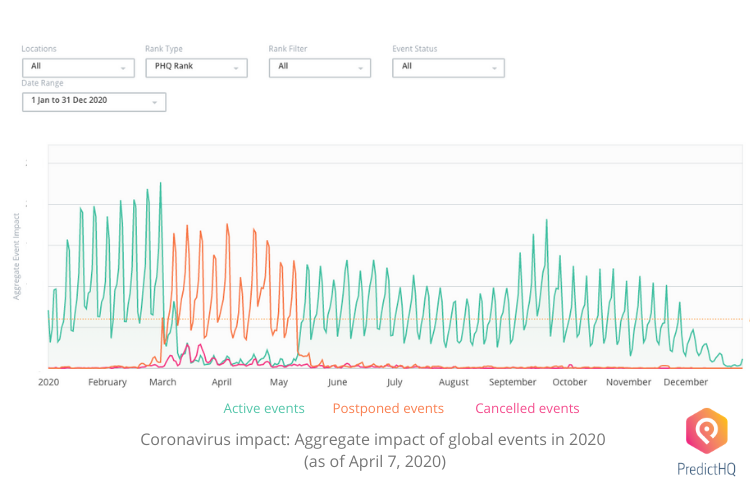

Below is a graph from our Aggregate Event Impact tool, which calculates and displays the combined impact of events on a particular location. Through this tool, our customers can track their relevant events in areas where they operated. Below is a visualization of the data in our Control Center, but most companies use the API endpoint directly in their modeling.

This graph displays the combined impact of all the world’s events across seven key categories for this year. As you can see, the impact of events prior to COVID-19 was massive, and the negative impact of the pandemic was severe.

However, also evident is the growing impact of events currently clustered around September or October, when many rescheduled events have new tentative dates.

Many events don’t yet have new dates. Event data is very dynamic – it’s why we update our API every minute to ensure it’s always accurate. We anticipate that once recovery trajectories are clearer, there will be an even higher increase in events scheduled in the later quarters of this year. Of particular note are the hundreds of postponed large conferences and expos that will now be squeezed into three to six months rather than 12, as well as major sports events such as the postponed NBA, baseball and football.How our Aggregate Event Impact tool works:

https://www.youtube.com/embed/3-U3TZJUeXY

Event reschedule rates will vary by country

It’s also important to note that the recovery commencement and duration will vary by country, potentially very significantly. Because so much is in flux at this stage, we are seeing most countries show a marked increase in events in late May but this is probably more to do with the CDC mass gathering advice. We urge people to be mindful that more event delays and postponements are likely for at least another three months. Because there will be thousands of impactful events being rescheduled or new events, manual tracking is simply impossible.

When the recovery begins, and demand and events return, we will begin sending out a weekly update of the rate of events that are rescheduled and new dates, as well as some of the highest impact events or clusters of events with new dates our systems have identified that week.

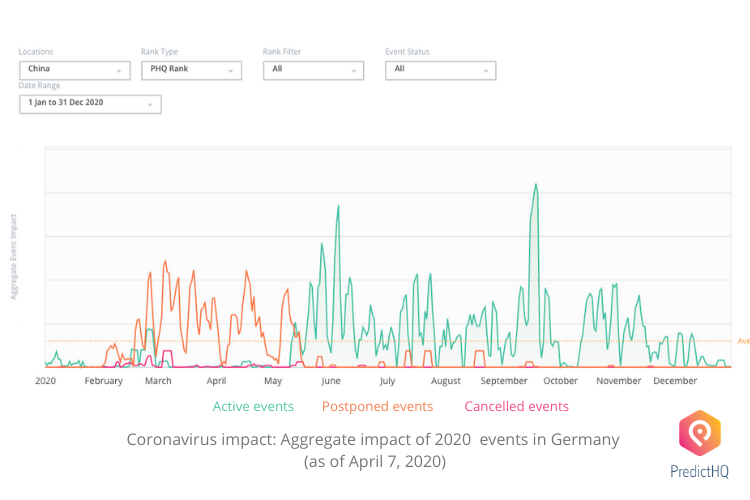

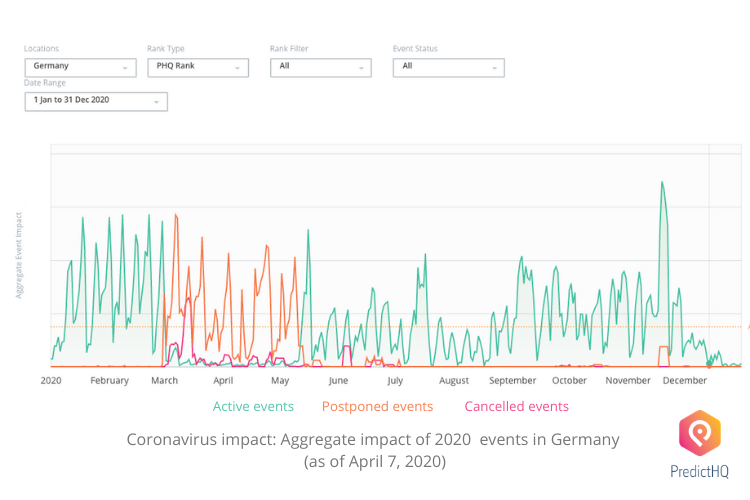

For example, China, the United States and Germany are all seeing a similar pattern of event dates, although they are likely to have quite different recovery trajectories based on when the virus peaked in each country.

China

USA

Germany

Our systems check and verify every event constantly, and we also manually check the details of all events we rank at 90 or above. PredictHQ’s ranking systems assign a log-scaled number between 0 to 100 to each event based on its predicted impact. Our data team is finalizing a new series of models that will link original dates to rescheduled dates, so companies are able to easily track the new dates for their most impactful events at scale.

Get ahead of the curve by signing up for updates on event reschedule dates

For those charged with crafting strategies for when demand begins to recover, we encourage you to to sign up for our updates that will share a curated list of broad economic leading indicators relevant to demand forecasting, the rate of events being rescheduled as well as some of the highest impact events or clusters of events with new dates our systems have identified that week.