Upcoming Events in Europe: Leading Demand Indicators as of July 2021

As European countries continue their efforts to vaccinate their populations to enable life to transition towards a new normal, businesses are constantly refining their recovery strategies to align with the rapidly changing environment. Key to this is tracking impactful events, which drive people movement and purchasing for businesses from food retail to transport to accommodation and more.

With Covid-19 cases rising for the first time in 10 weeks, it’s hard to predict how the next few weeks and months will pan out. We are working closely with our customers in Europe but wanted to provide an overview of event activity for everyone.

This is our first monthly report into the return of large events across Europe. Trying to summarize the salient details about the state of restrictions and the return of large events in Europe is a complex task. Even in our regular reports for the USA or the UK, the differences are so significant between each state, county and sometimes even cities within the same state (such as California) that identifying the overall trajectory is hard.

The state of events in Europe in mid 2021

PredictHQ tracks 19 categories of impactful events. This report mostly focuses on what we call scheduled, attended events, which were the most disrupted by the pandemic. This includes:

Sports

Concerts

Conferences

Expos

Festivals

Performing arts events

Community events

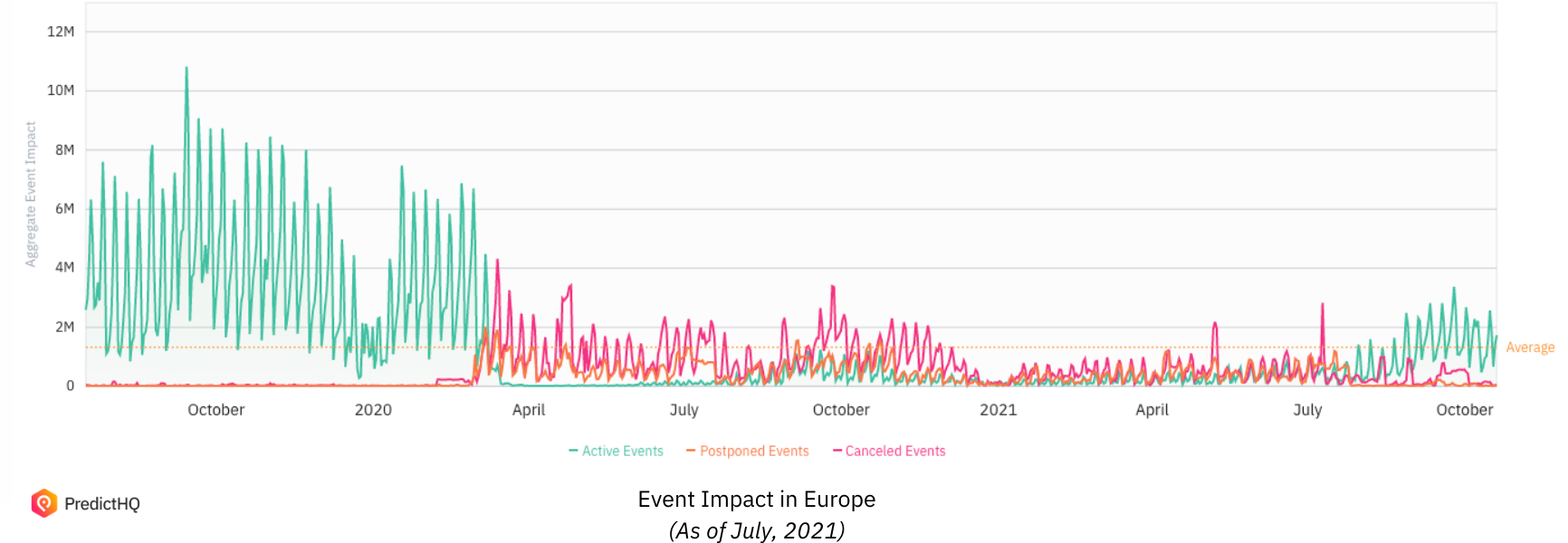

This graph aggregates the impact across all of these event categories, across Europe, from mid 2019 through to October 2021.

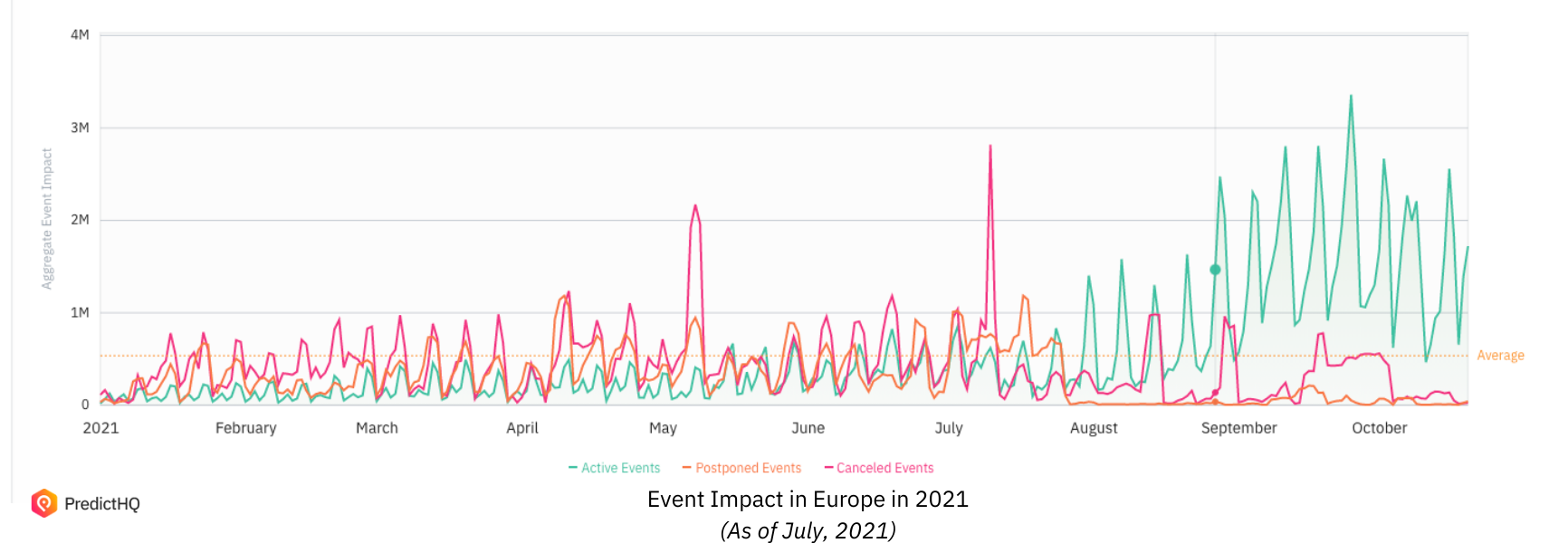

As you can see, events came to a grinding halt in mid 2020, but are beginning to recover now. Focusing in on 2021 and excluding the cancelled and postponed events from the graph (as event scheduling also stopped in mid 2020), the recovery of Europe’s event industry is easier to identify.

It is important to recognize that Europe is made up of countries with a range of vaccination rates, containment and management policies. We will focus on the larger countries within Europe in this analysis, but we have global event coverage so get in touch if you’re interested in a country we have not covered, or for more in-depth insight into any city or event category.

The impact of the delta variant rise in late June

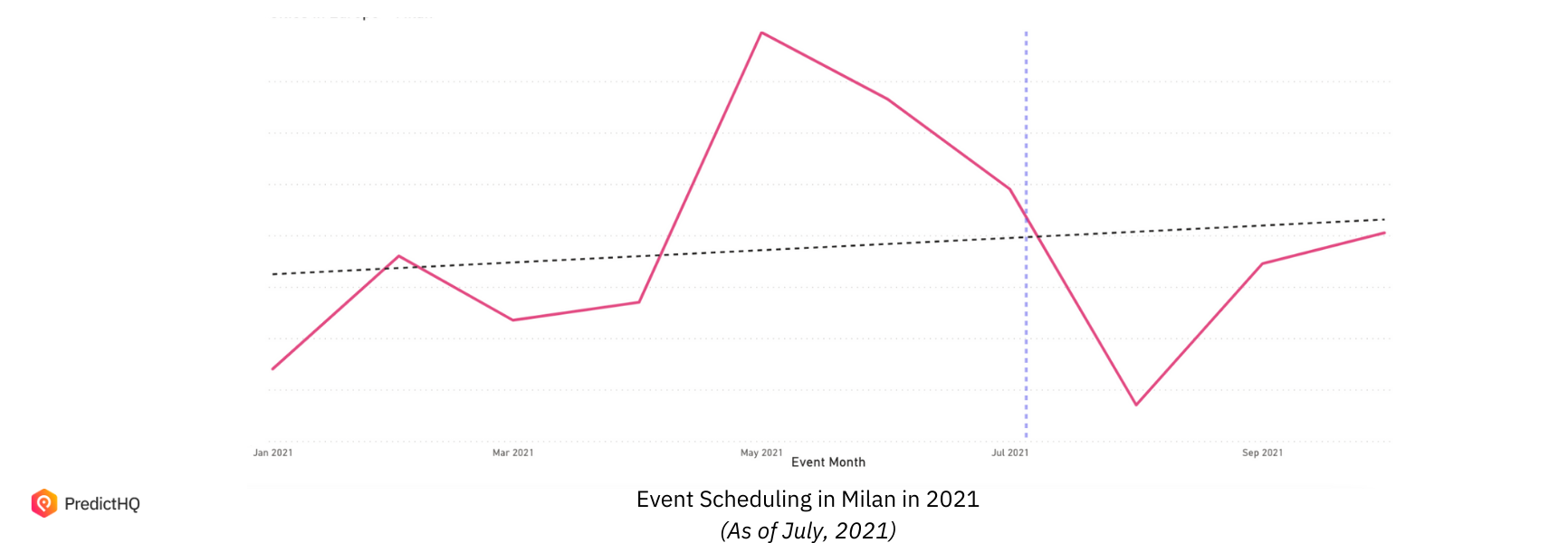

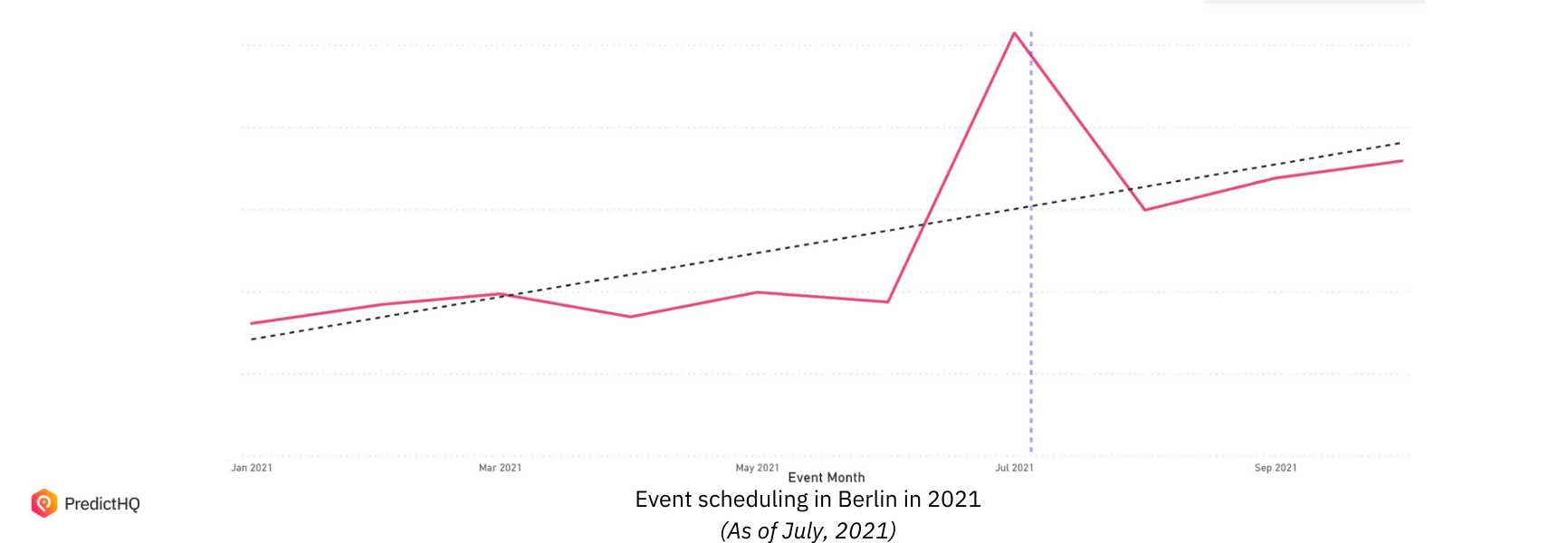

If you, like us, were wondering about the impact of the recent surge in COVID-19 delta variant on event scheduling, the clearest way to view its early impact is looking at the amount of events booked on a weekly basis.

So far, the rising cases due to the delta variant spread has caused a dip in event scheduling as of early July across most European major cities, but with most bouncing back. This rebound is likely to change with significant extensions or introductions of lockdowns if the delta variant continues to drive case rates up.

Upcoming event impact across Europe’s three most populous countries

Germany: In lockdown but event scheduling rising

Germany is one of Europe’s largest countries and prior to COVID-19, it was a global destination for many expos and conferences. Here is how the pandemic impacted attended events in Germany:

To put this in context, in 2019, Germany hosted:

9,203 conferences

3,031 expos

13,373 sports games

And more than 51,000 concerts

While event levels are yet to begin the rapid recovery we’ve seen in highly vaccinated countries such as the USA and the UK, large events are being planned as Germany considers lifting all restrictions in August for the not-too-distant-future including:

VeggieWorld Frankfurt at Fredenhagen Sprendlinger Landstrasse on September 11-12 with more than 2,000 people expected

Gartenfestival Herrenhausen (Herrenhausen Garden Festival) at Herrenhausen Gardens on July 30-August 1 with 1,500 people expected

NORLA (North German Agricultural Exhibition) at Messerendsburg on September 2-5 with 4,000 people expected

Jeck im Sunnesching Festival at Kölner Jugendpark on September 4 with more than 1,000 people expected

Leipzig Kings vs Wroclaw Panthers at Alfred-Kunze-Sportpark on September 5 with 1,000 people

If your business operates in Germany, get in touch with our team to access insight into demand-driving events as they are scheduled, as well as stay up to date rescheduled events date & time, location and predicted attendance.

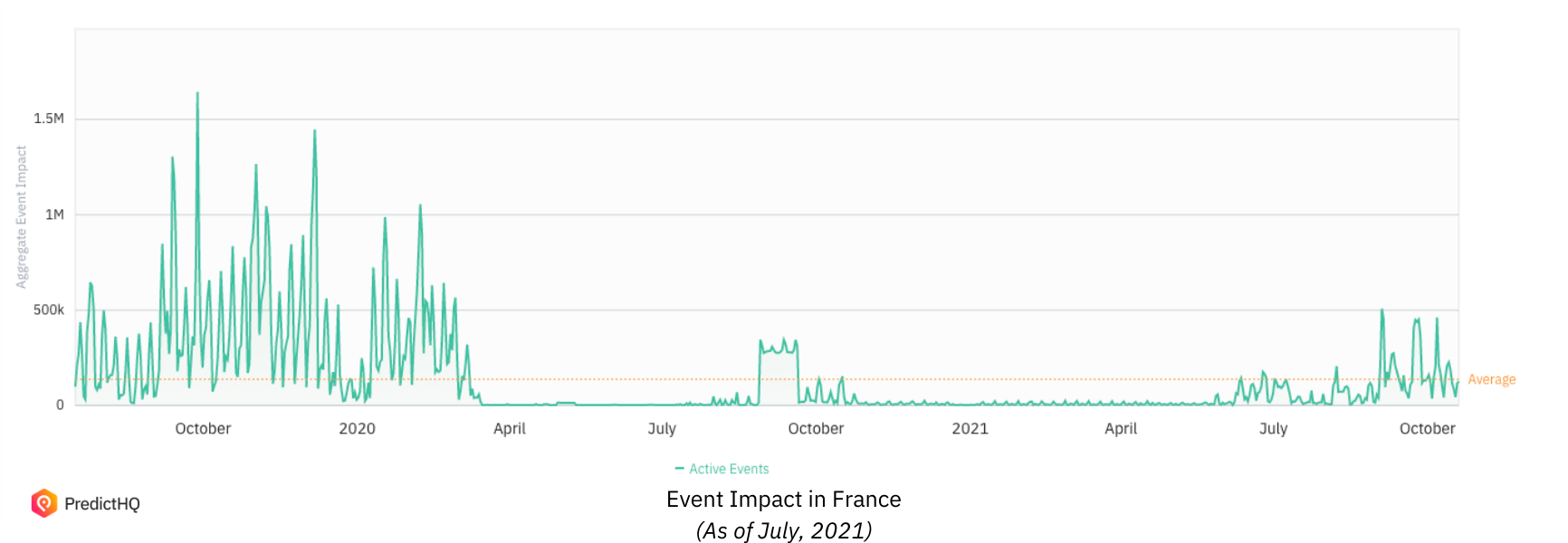

France: In lockdown but event scheduling rising

France is also in lockdown, but the event scheduling rate is different, as the country is scheduling by far the most events compared to other European countries. Below is the aggregated impact of events from pre-pandemic times through to October 2021.

Looking at new event scheduling across Europe, Paris, France continues to be by far the most active event scheduling location. Comparatively, we are also seeing significant activity in Belgium and the Netherlands, with activity beginning to pick up in Germany (as seen above), Italy and Madrid, Spain.

Upcoming impactful events in France:

Tour de France, across France, on June 26 to July 18 with 8 millions people expected

Festival Interceltique, in Lorient, on August 6 to July 15, with up to 500,000 people expected

Foire Internationale de Toulouse, at MEETT, on the 4 September to 13 September, with 80,000 people expected

Art Paris, at the Grand Palais Ephemere, on 9 September to 12 September, with 45,545 people expected

Nuits Sonores, in Lyon, on 20 - 25 July, with 15,000 people expected

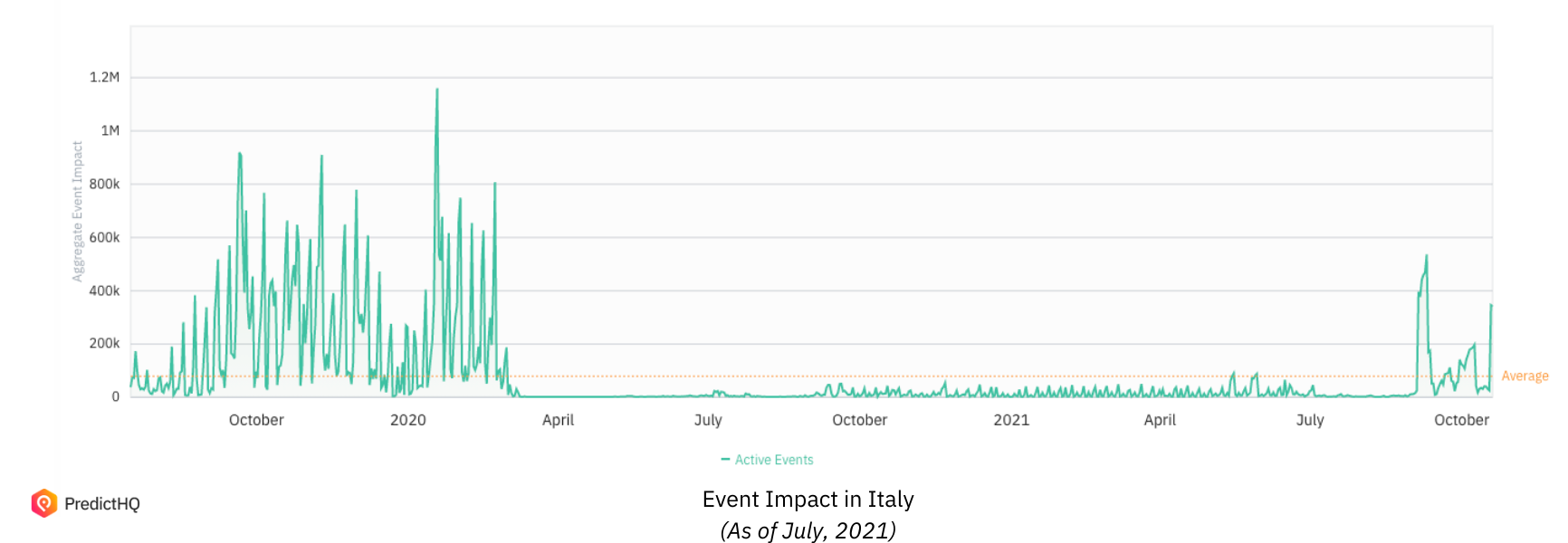

Italy: Event recovery beginning

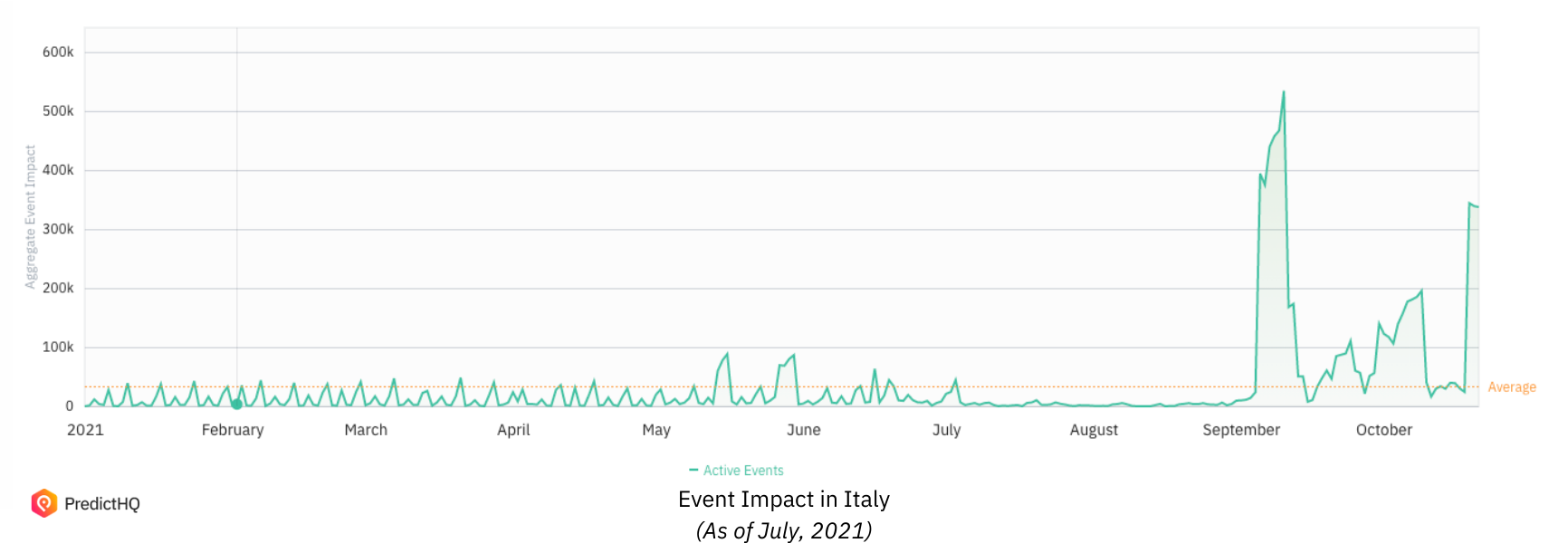

Unlike Germany and particularly France, Italy did not experience a minor mid-year event recovery surge. But events are being scheduled rapidly starting in October, with some larger postponed events causing perfect storms of demand.

Here’s a closer look at events in Italy in 2021:

If your business is in Italy, get in touch so we can ensure you are across all of these event-driven demand surges before they happen, so you can prepare to make the most of them.

Some upcoming events in Italy include:

RiminiWellness at Rimini Fiera on September 24 - 26 with 15,000 people expected

Ypsigrock Festival at Castle of Castelbuono on August 5 - 8 with 8,000 people expected

Run Rome The Marathon at Via dei Fori Imperiali on September 19 with potentially 100,000+ runners and spectators expected

Cibus at Fiere di Parma on August 31 - September 3 with 8,000 people expected

Italian Grand Prix at Autodromo Nazionale Monza on September 10 - 12 with up to 100,000 people expected

This report begins to outline the general trajectory and trends of event recovery across countries in Europe. With each country experiencing a different recovery journey, and the rise of the delta strain disrupting long-planned economic recoveries, it’s never been more important for businesses to have accurate up-to-the-minute intelligent event data. To make the most of events in your forecasting, you will need to use programmatic solutions given what dynamic and large datasets event data can be.

PredictHQ is supplying our customers with impactful events across the world, both verified and standardized, from 19 event categories in one API. To find out how leading companies such as Uber, Domino’s, and major hotel chains are using this data, explore our use cases.

We will be releasing monthly editions of this Leading Demand Indicators report for Europe. Sign up to receive it in your inbox as soon as it’s published.